Most consumers, especially those who travel frequently, are familiar with airline-affiliated credit cards, through which you earn free mileage based on how much you charge to your card. But if you're an avid cruiser, especially one who prefers to drive or take the train to the cruise port, a card that earns you points toward cruise-related awards might be a better fit. So do such cards exist?

Most consumers, especially those who travel frequently, are familiar with airline-affiliated credit cards, through which you earn free mileage based on how much you charge to your card. But if you're an avid cruiser, especially one who prefers to drive or take the train to the cruise port, a card that earns you points toward cruise-related awards might be a better fit. So do such cards exist?

They do, but only a few cruise lines offer them. In fact, cruise line-affiliated credit cards are only an option among the biggest names in mainstream cruising. Of the 18 lines surveyed, only six had co-branded credit cards: Carnival Cruise Lines, Disney Cruise Line, NCL, Princess Cruises, Holland America and Royal Caribbean.

Unlike hotel- and airline-affiliated credit cards, cruise credit cards are not linked to the cruise operators' loyalty programs. That's likely because cruise loyalty programs are themselves quite different from the frequent traveler programs run by the airlines and hotel companies. Spending more with your credit card won't bump you up to platinum status, but it could get you a free cruise. Here's how:

How Affiliated Credit Cards Work

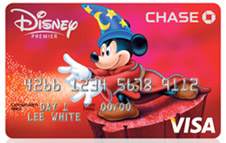

The cards offered by these six lines are more alike than they are different. Five out of six award two points for every dollar spent on cruise services and products, and one point for every dollar spent on other charges. The outlier, the Disney Premier Visa card, awards two points per dollar for charges at gas stations, grocery stores and restaurants, in addition to Disney services and merchandise.

On the redemption side of the ledger, you can exchange your points for free or discounted cruises, onboard credit, upgrades, onboard amenities and cruise line merchandise. Points have a value of 1 cent apiece when cashed in for most rewards. So, for example, a 0 credit toward onboard purchases can be had for 10, 000 points. If those points were earned at the rate of one point per dollar in charges (as they will be in the great majority of cases) that 0 credit would amount to getting a 1 percent rebate on , 000 in charges.

Another feature common to all six cards: Points expire after five years. Five of the six carry no annual fee; again, the exception is Disney's Premier card.

Another feature common to all six cards: Points expire after five years. Five of the six carry no annual fee; again, the exception is Disney's Premier card.

Should You Choose a Cruise Card?

If you're a frequent cruiser on any of these six lines, you might be tempted to apply for a card. But does it make sense to get a cruise credit card versus a different type of rewards card?

Maybe. Maybe not. It depends on your goals.

If you want to get the best return on investment from a credit card, cruise credit cards aren't the way to go. With most charges yielding just a 1 percent effective rebate on a limited catalog of awards, cruise credit cards aren't top-of-the-class in terms of value or rewards flexibility.

For comparison, look at airline credit cards. While the average value of a frequent flyer mile is around 1.2 cents - which amounts to getting a 1.2 percent rebate when earning one mile per dollar charged - that per-mile value can be increased considerably by cashing in miles for higher-priced award flights. Some cash-back credit cards rebate 1 to 2 percent or more for select categories. And your reward is cash, which can be used to pay for anything, from a cruise to other travel expenses (pre-cruise air or hotel, for example) or even a new wardrobe for your upcoming sailing.

In other words, if your choice of credit cards is based strictly on bottom-line considerations, the value of a cruise card is readily trumped by that of other types of cards.

On the other hand, maybe a free or discounted cruise is such a high priority that the value and flexibility tradeoffs are incidental. Your eye is on the prize, and you're going to charge, charge, charge until you get that free cruise (or other cruise-related award). In that case, a cruise credit card might suit your goals just fine.

Just make sure you do the math first. Depending on your monthly credit card purchases, the five-year points-expiration policy could mean that some of the most expensive awards will simply remain out of reach because you won't be able to earn enough in that time period. If you intend to use your card for all of your day-to-day purchases and pay off the balance each month, you will likely be able to accrue enough points for a free cruise every couple of years. But otherwise, you may not, and those points will go to waste.

Editor's Note: We have a few friends who have lost all of their reward points on cruise line credit cards when the bank/cruise line affiliation was discontinued and the type of card they had ceased to exist. If you do choose a cruise line card, keep in mind that these things sometimes happen with less popular/lucrative credit programs.

Editor's Note: We have a few friends who have lost all of their reward points on cruise line credit cards when the bank/cruise line affiliation was discontinued and the type of card they had ceased to exist. If you do choose a cruise line card, keep in mind that these things sometimes happen with less popular/lucrative credit programs.

Don't forget to factor in the double points for purchases with the cruise line. You'll rack up award points more quickly if you're booking two cruises a year with the same line than if you sail every other year or try out different cruise companies.

If you think a cruise card is right for you, here's a more detailed summary of the cards' features and benefits:

Carnival Cruise Lines

Credit card: Carnival World MasterCard, issued by Barclays Bank

Earning points: Cardholders earn two FunPoints for every dollar spent with Carnival and one FunPoint for other charges. You'll receive a signup bonus of 5, 000 FunPoints after the first use. There are no maximum earnings, but points expire after five years.

Getting rewards: Points may be redeemed for a statement credit toward cruises on the World's Leading Cruise Lines (Carnival Cruise Lines, Costa Cruises, Cunard Line, Holland America Line, Princess Cruises and Yachts of Seabourn) or an airline or hotel charge, onboard amenities, gift cards, gift certificates or merchandise. For most rewards, the point value is around 1 cent apiece - a 1 percent rebate.

Fine print: An additional bonus of 5, 000 FunPoints is available for balance transfers made within thirty days of opening your account. (Balance transfers each incur a small fee.) The card does not carry an annual fee. The annual percentage rate on charges is 13.99 to 20.99 percent, depending on creditworthiness.

Fine print: An additional bonus of 5, 000 FunPoints is available for balance transfers made within thirty days of opening your account. (Balance transfers each incur a small fee.) The card does not carry an annual fee. The annual percentage rate on charges is 13.99 to 20.99 percent, depending on creditworthiness.

Disney Cruise Line

Credit card: Disney Premier Visa or Disney Rewards Visa, issued by Chase

Earning points: Cardholders earn 2 percent in reward dollars for every dollar spent with Disney or at gas stations, grocery stores and restaurants, and 1 percent for other charges with the Premier card and 1 percent on all purchases with the Rewards card. You'll receive a bonus of a $100 Disney gift card if you charge $500 on the Premier card within the first three months or a $50 Disney gift card after the first use of the Rewards card.

Getting rewards: Reward dollars may be redeemed for Disney cruise vacations, merchandise, spa treatments and shore excursions, as well as Disney theme park tickets, other Disney products and a statement credit toward airfare. Reward dollars, as the name implies, are worth $1 a piece and can be redeemed for goods and services at that rate, which amounts to a 1 to 2 percent rebate, depending on how they're earned. There are no maximum earnings, but reward dollars expire after five years. Additional year-round perks are available for all card members, including onboard credit offers and discounts for onboard services and discounts at Disney stores, theme parks and resorts.

Fine print: The Rewards card has no annual fee, and the Premier card carries an annual fee of $49. Both cards offer a 0 percent annual percentage rate on charges for the first six months, which will then increase to is 15.24 percent.

Holland America Line

Credit card: Holland America Line Rewards Visa, issued by Barclays Bank

Earning points: Cardholders earn two points for every dollar spent with Holland America and one point for other charges. You'll receive a signup bonus of 5, 000 points after the first use.

Getting rewards: Points may be redeemed for cruises, cruise discounts, onboard credits, onboard experiences, merchandise and other onboard for-fee amenities. For most awards, the point value is around 1 cent apiece, which amounts to a 1 percent rebate for most charges. There are no maximum earnings, but points expire after five years.

Fine print: The card does not carry an annual fee. The annual percentage rate on charges is 13.99 to 20.99 percent, depending on creditworthiness.

list of good deeds done by kids mr good deeds cast no good deeds movie time good deeds in spanish 3 good deeds watch good deeds online doing good deeds in the bible barack obama good deeds tyler perry good deeds online full movie good deeds christmas good deeds xenoblade chronicles 2 good deeds good deeds pelicula cam newton good deeds good deeds story watch full movie good deeds no good deeds dvd can good deeds get you to heaven good deeds 123movies bible verse about doing good deeds without recognition good deeds filmweb no good deeds tyler perry my good deeds are like filthy rags good deeds 2012 movie insurance commercial good deeds daddy good deeds ep 1 pope francis good deeds movie good deeds review good deeds mortgage good deeds movie rental bragging about good deeds bible good deeds make a list of good deeds list of good deeds to do for others no good deeds movie time what does the bible say about good deeds kim kardashian good deeds does god notice good deeds good deeds movie trailer good deeds for toddlers children doing good deeds good deeds soundtrack kem sims 4 good deeds badge good deeds 123movies bible verses about doing good deeds for others mr deeds looks good to me good deeds wikipedia good deeds tyler perry good deeds thrift store good deeds tyler perry torrent

RELATED VIDEO